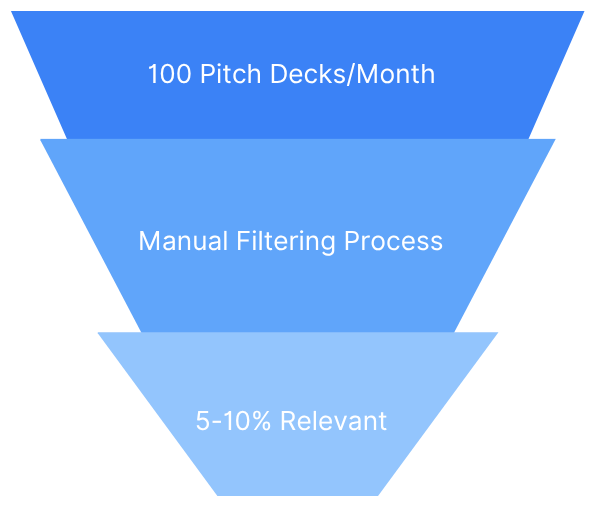

Problem 1: Filtering Top-of-Funnel deal flow

The Challenge

- Investors receive ~100 pitch decks monthly

- 90-95% don't match investment criteria

- Wrong geography, stage, vertical, or ticket size

- Significant time wasted on manual filtering

“We were wasting enormous amounts of time on top-of-funnel dealflow that didn’t match our criteria, and in 2023, we couldn’t find any tools that solved the problem.”

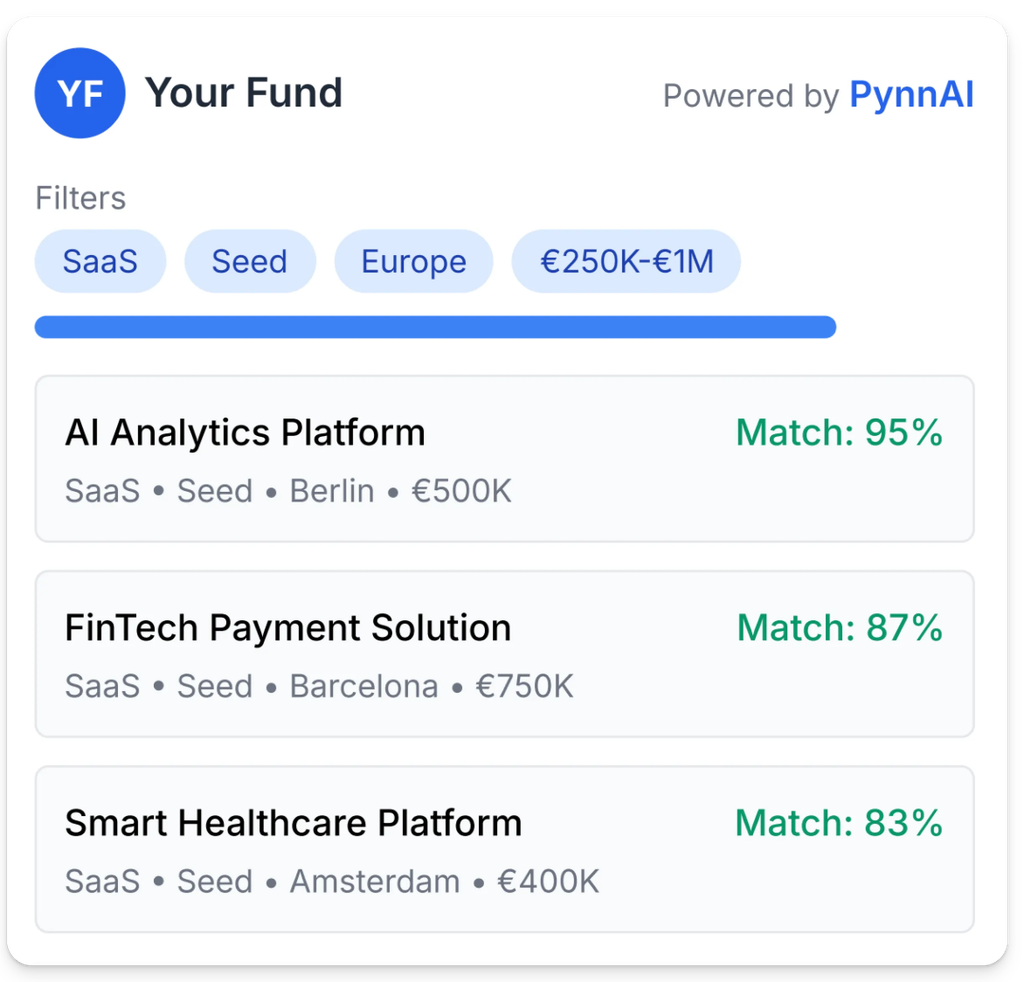

Solution 1: White Label Filtering Platform

Your Personalized Deal Flow Filter

✅ Create your own white-label version of Penn AI

✅ Invite startups to create profiles and submit their projects

✅ Filter based on your criteria - geography, vertical, stage, ticket size

✅ Only review profiles that match your investment thesis

✅ Save hour every week on screening irrelevant deals

"Create a white-label of Pynn AI, invite startups, and filter projects based on your criteria to review only the most relevant profiles.”

Problem 2: Startup Discovery Challenges

The Disconnect

- Investors in major hubs can't discover startups from smaller regions

- Rural startups struggle to find networks, angels, and mentors

- Geographic barriers limit exposure to funding opportunities

- Talent and innovation remain undiscovered outside major tech hubs

"Investors based in big cities miss startups from smaller regions—and those startups often lack access to networks, mentors, and support.”

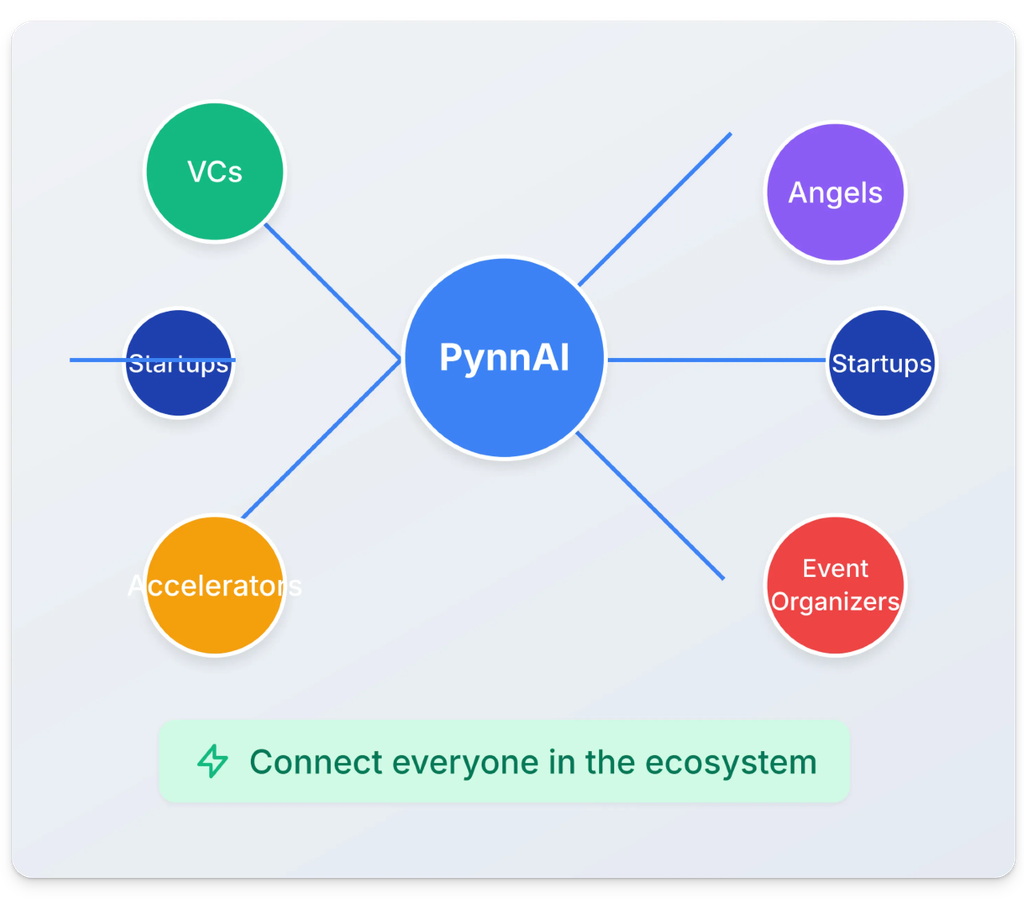

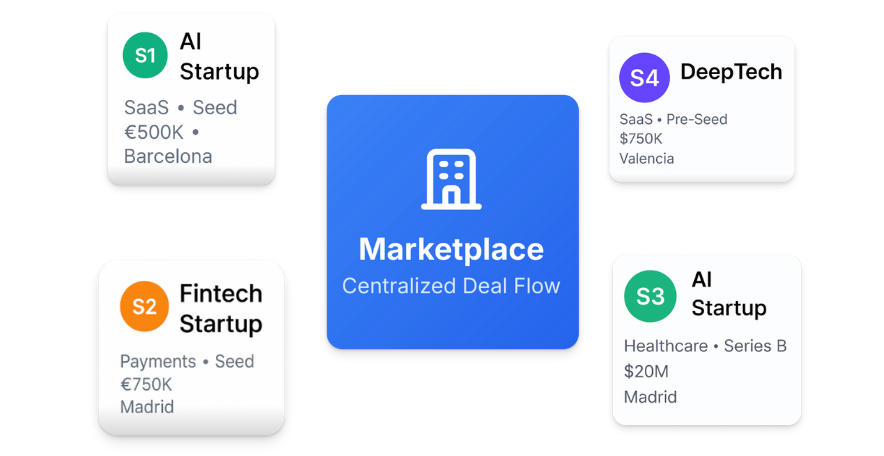

Solution 2: Centralisation

A Unified Platform for All

✅ Publish filtered dealflow on a centralized marketplace

✅ Create warm introductions and co-investment opportunities

✅ Break geographic barriers between startups and investors

✅ Enable collaboration between investment networks

✅ Developed white-label platforms fornevents, VCs, angel networks, incubtors, accelerators

"By white-labeling Pynn AI, platforms can share dealflow in a common marketplace—making warm intros, co-investments, and lead deals easier through collaboration.”

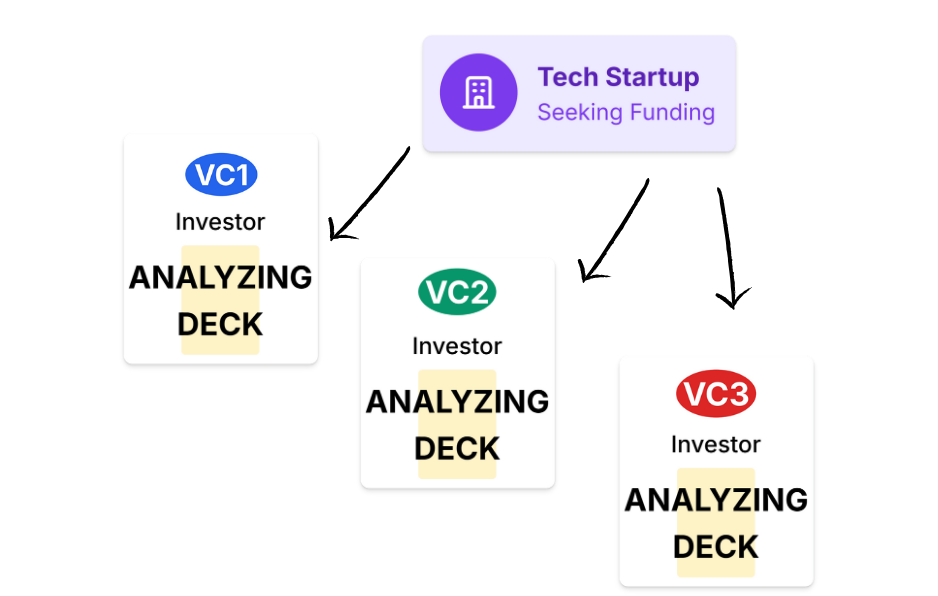

Problem 3: We are all doing the same Job

The Inefficiency

- Startups use "spray and pray" approach with investors

- Identical pitch decks sent to dozens of investors

- Investors duplicate analysis efforts on the same startups

- Hours of redundant work across the ecosystem

- No shared knowledge or collaborative filtering

“Startups often send the same decks to many investors, wasting time. Centralizing dealflow lets us know when a startup has already created a profile.”

Solution 3: The Marketplace

Centralized Deal Flow

✅ Shared marketplace where investors find startups, not the other way around

✅ Eliminate redundancy with unified startup profiles

✅ Search, filter and discover ideal investment opportunities

✅ Collaborative investment opportunities with fellow investors

✅ Track startup progress and engagement across the ecosystem

"By sharing dealflow on the same software, investors can easily find and connect with startups they’re interested in.”

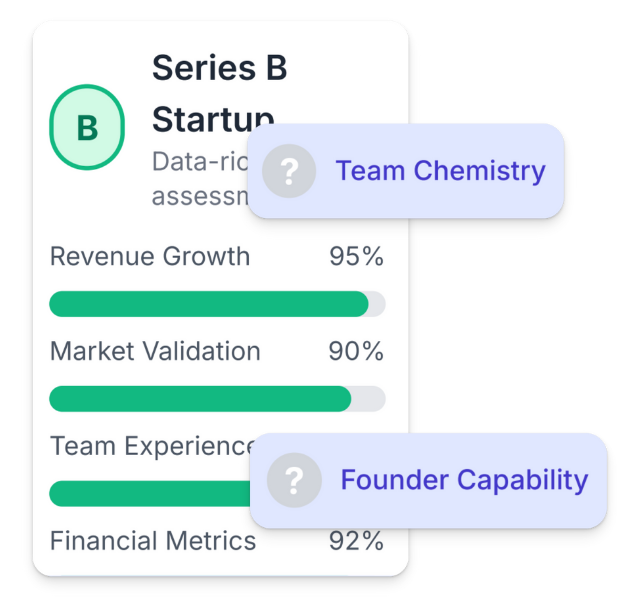

Problem 4: Lack of Data

The Data Gap

- Early stage startups have limited available information

- Not enough quantitative date points for informed decisions

- Soft skills and founder dynamics are crucial but hard to assess

- Traditional pitch decks don’t reveal team chemistry or execution ability

- Comparing similar startups is challenging without standardized metrics

"Early-stage startups lack data, so soft skills and founder presentation matter more than in later stages.”

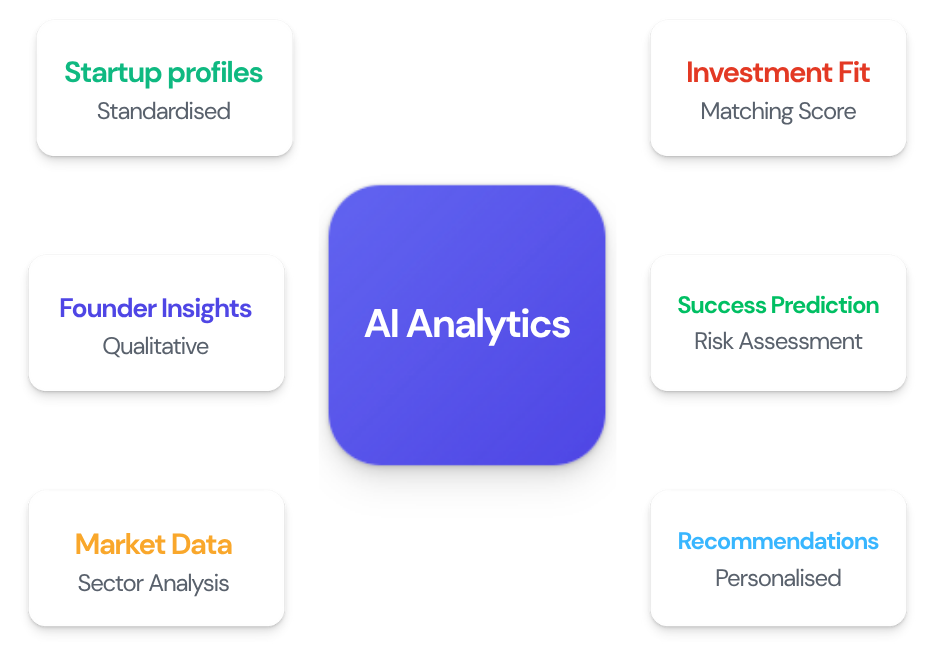

Solution 4: Big Data

Centralized Data for Intelligent Insights

✅ Compare similar startups in similar regions with

standardized metrics

✅ AI-powered interviews with founders to capture

qualitative insights

✅ Build a comprehensive database of early-stage startup

metrics

✅ Train AI to identify promising patterns and success

indicators

✅ Generate personalized investment recommendations

based on investor preferences

"Centralizing dealflow lets us compare similar startups—and soon, AI can learn from the data to make smart recommendations.”

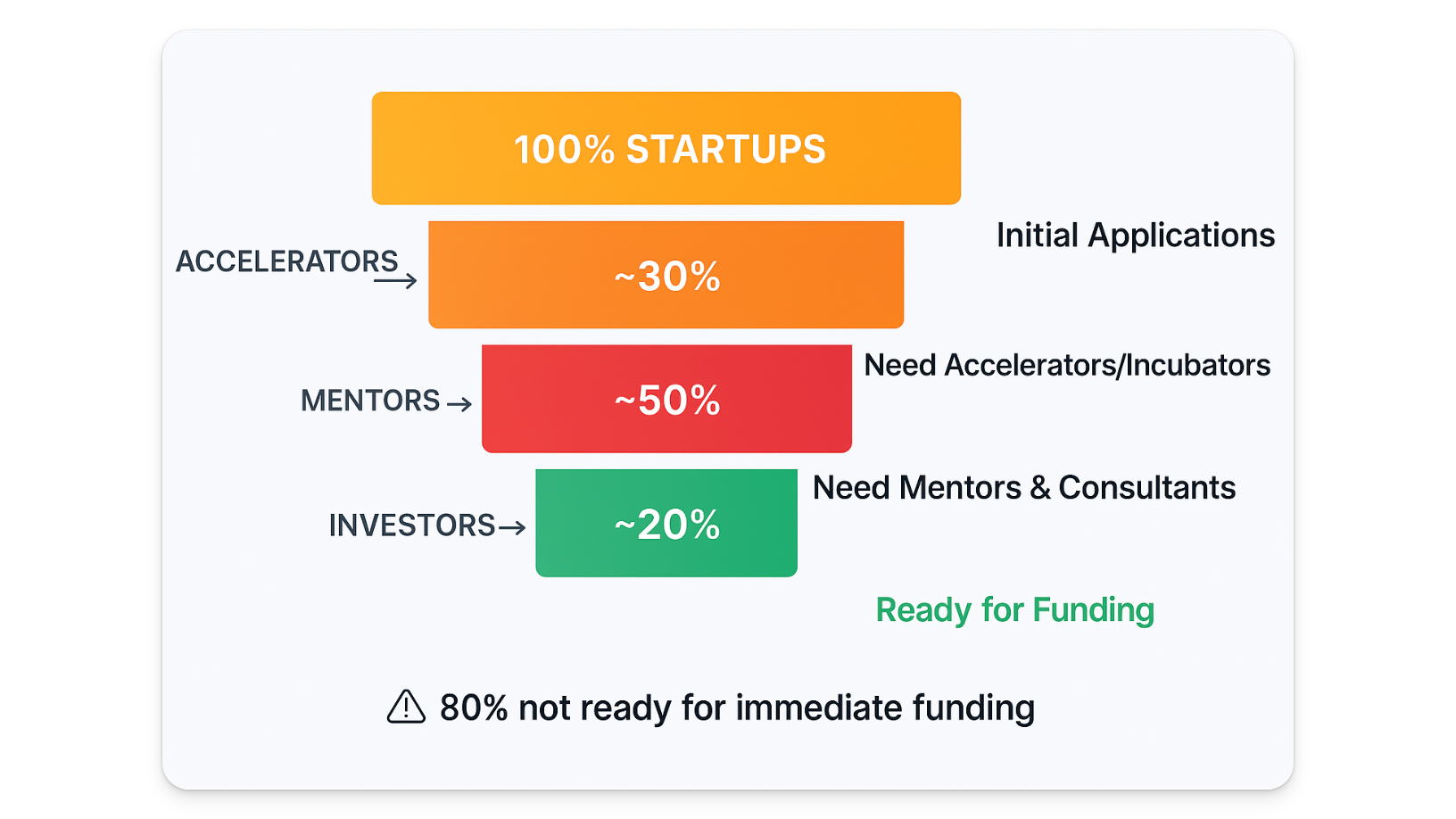

Problem 5: Founders not ready for Founding

The Readiness Gap

- A large percentage of startups seeking funding are not ready for a founding round

- Many founders need mentorship, guidance and education before investment

- Lack of business model validation or clear go-to-market strategy

- Limited understanding of investor expectations and fundraising process

- No clear path to connect with appropriate support resources for their stage

"Many startups aren’t ready for funding—they’d be better suited for mentors, incubators, or accelerators. How do we filter them out?”

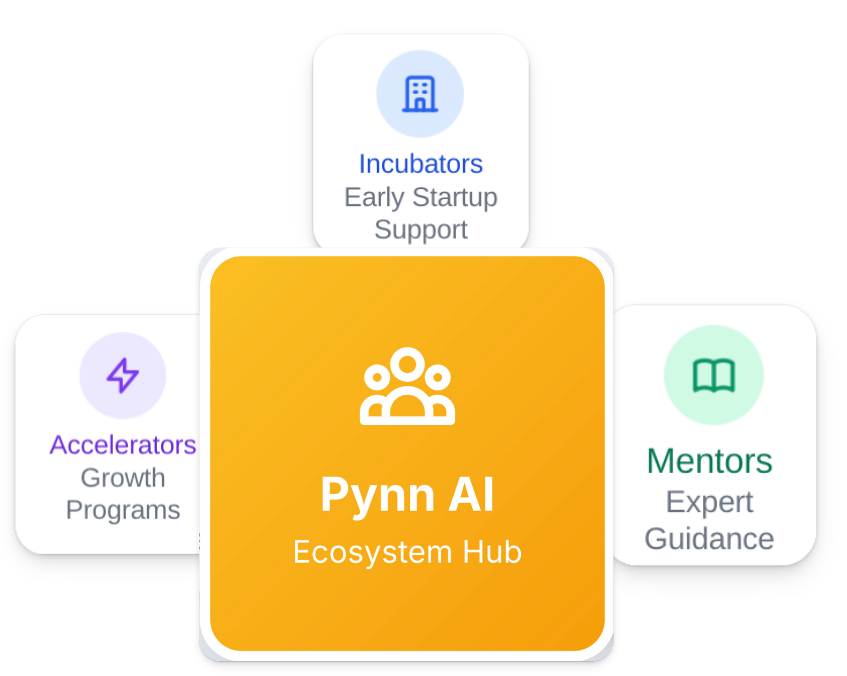

Solution 5: Service Providers and Introductions

Ecosystem for Startup Success

✅ Service providers join the platform to offer startup support

✅ Intelligent matching with region-specific resources

✅ Startups receive tailored guidance based on their stage

✅ Track progress with periodic resubmissions and

evaluations

✅ Investors can mark favorites and monitor growth until

funding-ready

"With service providers on the platform, we can guide startups to local support and track their progress through periodic reports.”